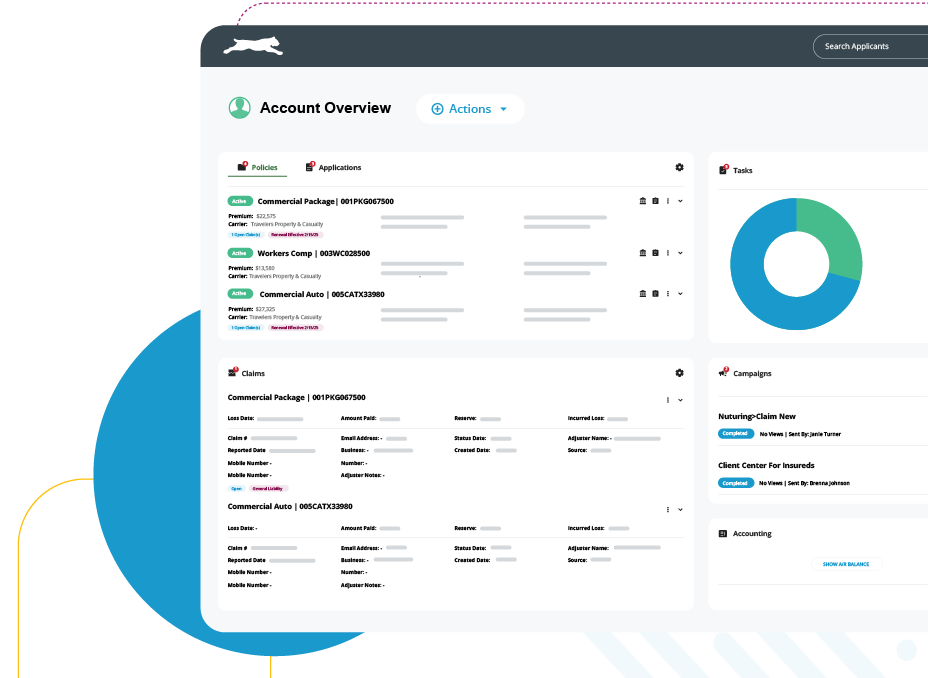

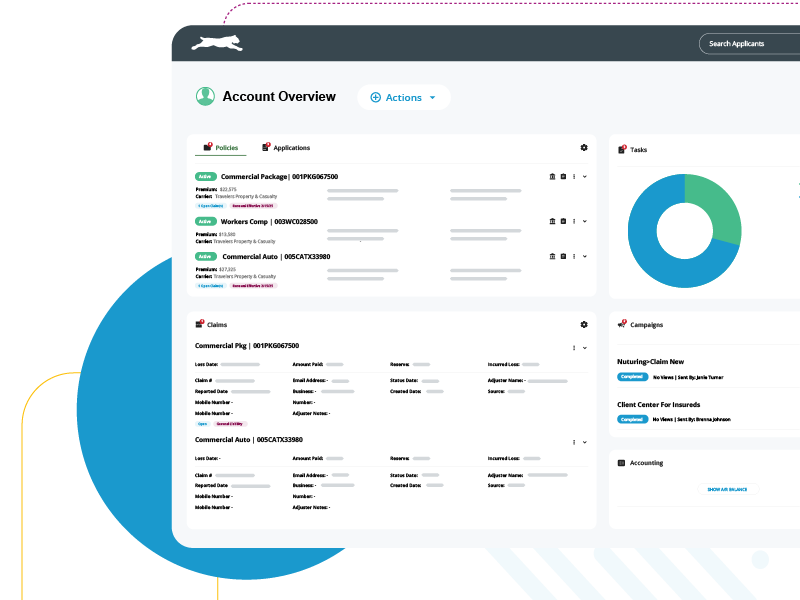

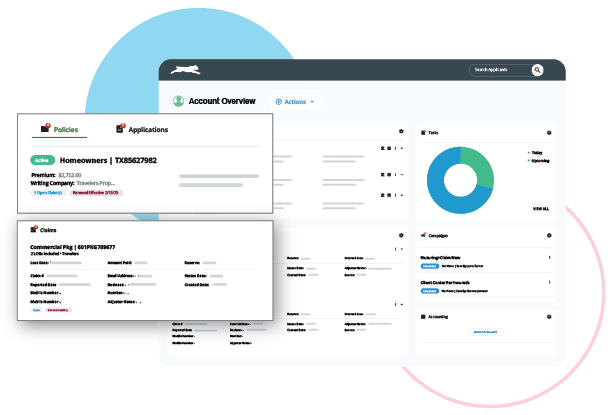

The all-in-one system that makes agencies more profitable

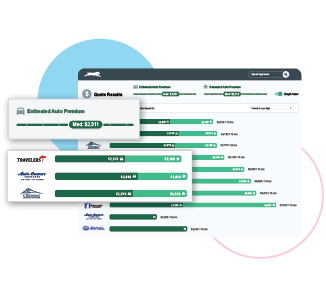

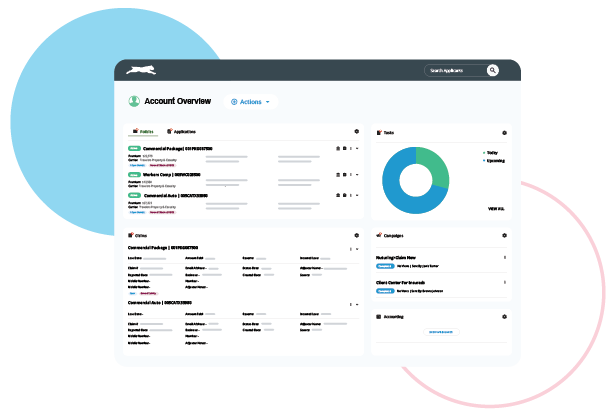

From quoting and policy management to servicing, renewals, and reporting, everything lives in one connected system. No more switching between tools or rekeying data. With EZLynx, you get a smarter, simpler way to manage the full insurance policy lifecycle.

Why insurance agencies choose EZLynx

Fewer Manual Tasks, More Time for Growth

Built-in AI and automation eliminate repetitive work, freeing your team to focus on clients and revenue.

Less Time Rekeying Information

Keep your data connected across quoting, servicing, renewals, and reporting so your team spends less time duplicating entries and more time driving results.

Better Digital Experiences for Clients

From self-service portals to personalized outreach, EZLynx helps you deliver the modern, connected experience today’s clients expect.

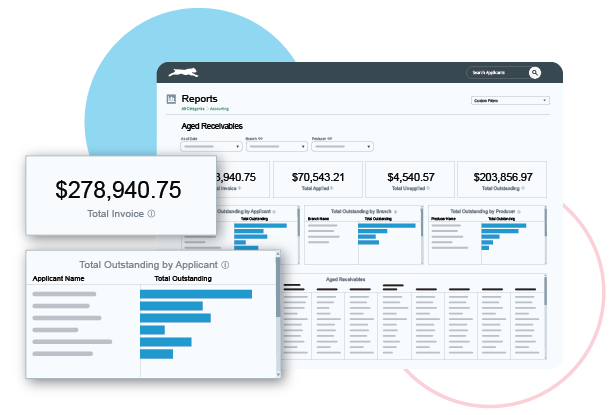

Smarter Decisions, Backed by Data

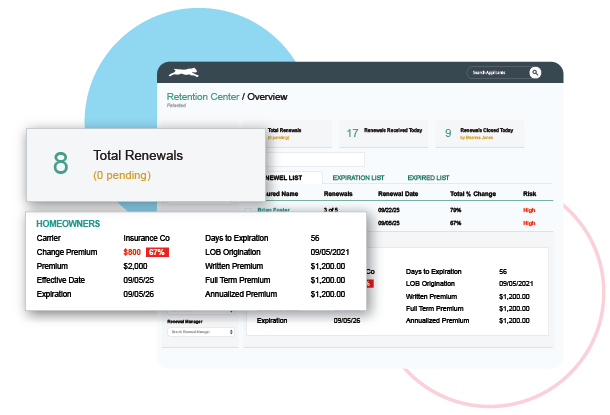

Real-time insights into performance, retention, and revenue help you make confident, data-driven decisions that move your agency forward.

Insurance agents like you use and love EZLynx

Agency management system FAQs

While some AMS vendors claim they offer “integrated solutions,” EZLynx truly is, with all features natively built-in versus separate, cobbled-together integrations. EZLynx supports policy management, personal lines rating, commercial lines submissions, marketing automation, accounting, reporting, and so much more. That means no more switching between systems or rekeying data, just a seamless experience from start to finish.

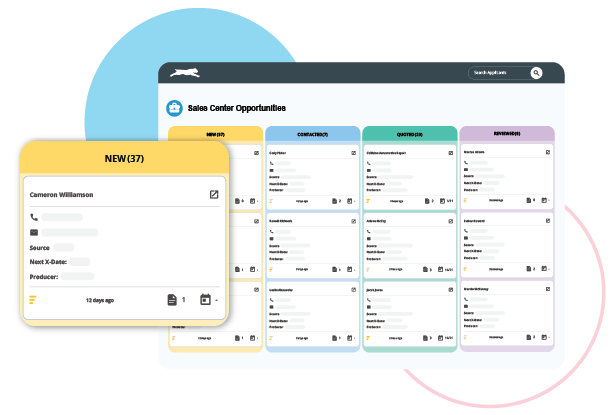

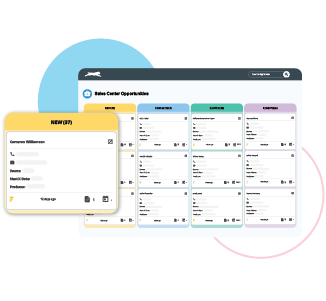

Yes! EZLynx offers a modern insurance Customer Relationship Management (CRM) tool that helps you identify the best targets and nurture prospects through the pipeline with automated email marketing campaigns. Even after converting a prospect to a customer, EZLynx ensures you keep those client relationships strong and nurtured for future upsell and cross-sell opportunities. Everything you need to manage your sales pipeline and provide targeted information and advice is within our single platform.

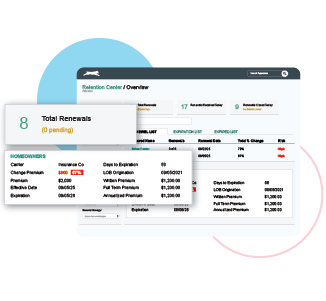

EZLynx’s patented customer retention software prioritizes at-risk policies, summarizes premium-bearing changes, and automates follow-ups so you can touch 100% of renewals. This helps you lower customer churn and boost customer satisfaction.

EZLynx includes automation functionality that takes care of those repetitive but essential tasks so that you can focus on revenue-generating activities. Use it to capitalize on more sales opportunities, improve follow-up, reduce manual data entry, track and assign employee workflows, and even automate email campaigns.

Getting started is simple. Our team will guide you through onboarding and setup, and because everything is in one system, your team will be up and running with less training and fewer headaches.

EZLynx uses artificial intelligence (AI) to make your workflows smarter and more efficient. From intelligent automation that reduces manual tasks to data-driven insights that help you prioritize renewals and opportunities, AI is built into the platform to help your team work faster, stay proactive, and focus on what matters most to your clients.

Resources

-

8 Steps to Implementing an AMS at Your Agency

8 Steps to Implementing an AMS at Your AgencyGain a clear understanding of how an agency management system can transform your operations and the steps to get started with one.

View Guide

-

Transform Your Insurance Agency with EZLynx AMS

Transform Your Insurance Agency with EZLynx AMSCentralize your tools with a single insurance AMS to enhance workflows, reduce manual processes, and gain real-time insights into your agency’s performance.

View Infographic

-

How to Find the Best Insurance Agency Management Software

How to Find the Best Insurance Agency Management SoftwareGet an explanation of an agency management system, the benefits of a good system and a checklist to help you choose the right one.

View Guide

Resources

-

8 Steps to Implementing an AMS at Your Agency

8 Steps to Implementing an AMS at Your AgencyGain a clear understanding of how an agency management system can transform your operations and the steps to get started with one.

View Guide

-

Transform Your Insurance Agency with EZLynx AMS

Transform Your Insurance Agency with EZLynx AMSCentralize your tools with a single insurance AMS to enhance workflows, reduce manual processes, and gain real-time insights into your agency’s performance.

View Infographic

-

How to Find the Best Insurance Agency Management Software

How to Find the Best Insurance Agency Management SoftwareGet an explanation of an agency management system, the benefits of a good system and a checklist to help you choose the right one.

View Guide