Insurance shoppers are looking for fast, competitive quotes from multiple carriers.

EZLynx helps independent insurance agents meet these expectations. Our all-in-one solution comes with built-in personal lines rating and commercial lines submission tools so you can manage the entire policy lifecycle in your agency management system workflow. You only have to enter applicant data once, and our personal lines rater will instantly return accurate, real-time Home and Auto quotes from multiple carriers. When your commercial lines submission is ready, you can connect with appointed carriers to receive commercial quotes directly within EZLynx, thanks to our native commercial lines solution.

How can EZLynx simplify your rating and submissions workflows?

Our comprehensive solution allows you to quote, bind and remarket in one system so that you can deliver fast, superior service.

- Enter date once and get multiple, accurate PL quotes

- Remove the guesswork from preparing, organizing, and tracking commercial submissions with easy-to-follow workflows

- Remarket policies without rekeying data

The value of using EZLynx for PL quoting and CL submissions

-

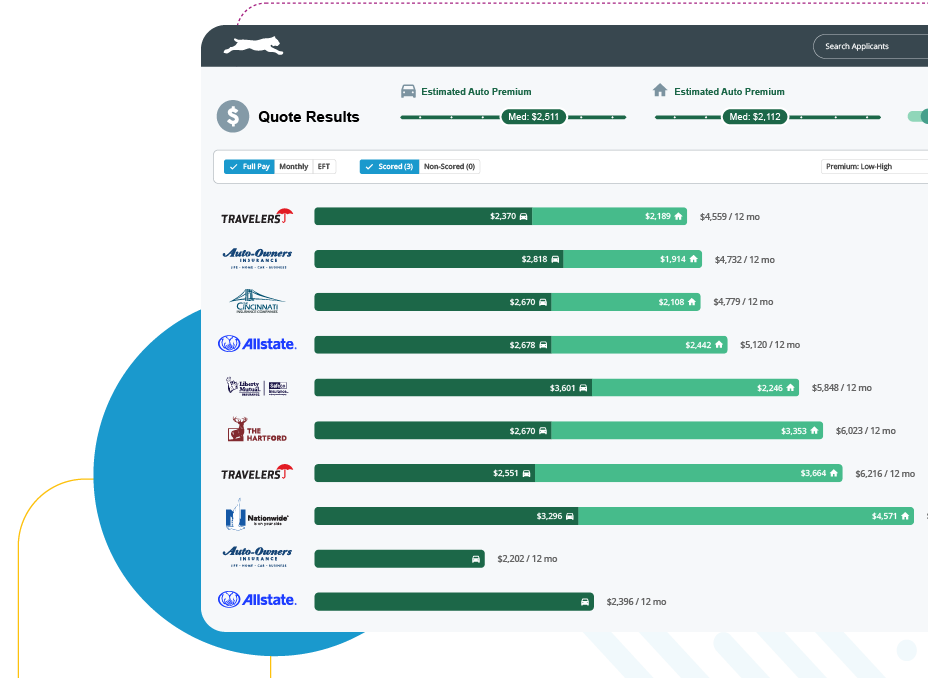

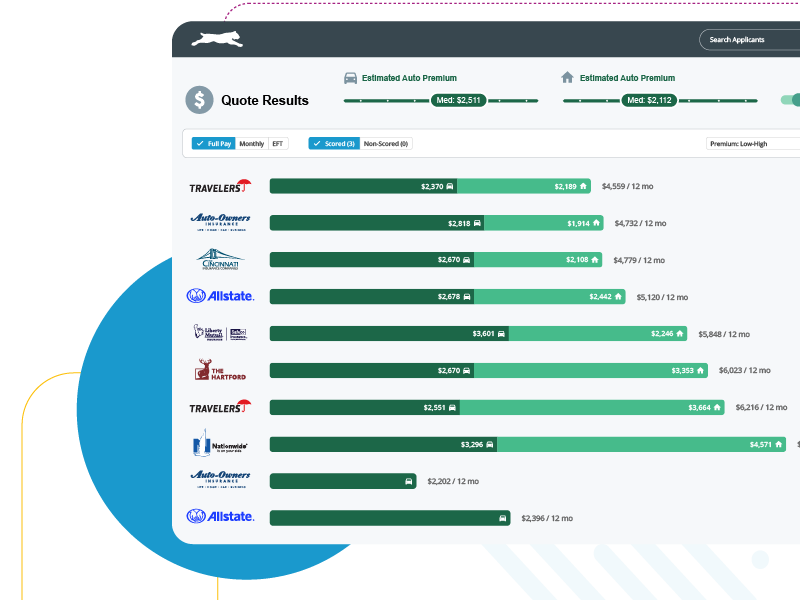

Access the broadest personal lines panel

Access the broadest personal lines panel

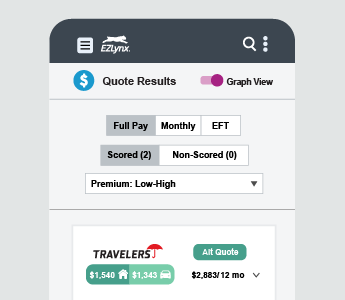

With EZLynx Rating Engine, you can get real-time quotes from hundreds of carriers across 48 states on any device – even your phone.

-

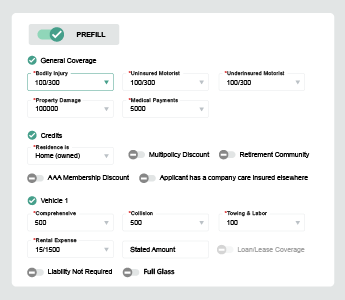

Prefill and lookup data for efficiency

Prefill and lookup data for efficiency

Our comparative rating workflow is packed with time-saving features like data pre-fill and lookup that empower your agency to quote more in less time. No duplicate entry, no wasted time – just streamlined cross-carrier quoting made easy.

-

Centralize commercial quotes

Centralize commercial quotes

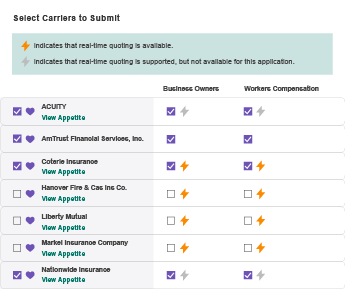

A native commercial lines comparative rater allows you to collect data, find in-appetite markets and submit to multiple carriers within EZLynx versus visiting individual carrier websites.

-

Track submissions from a single screen

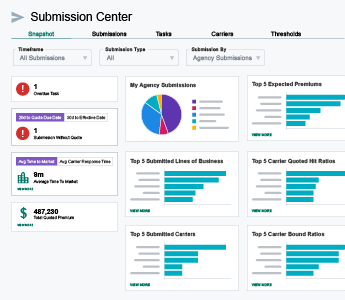

Track submissions from a single screen

A dynamic, intuitive dashboard drives daily tasks and lets you zero in on critical action items for moving submissions to the next transition point.

-

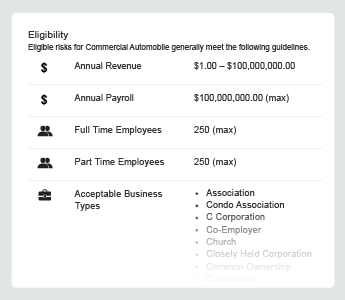

Validate carrier appetite

Validate carrier appetite

Powered by Ask Kodiak® technology, a simplified North American Industry Classification System (NAICS) lookup feature lets you check insurance carrier appetite before submitting new business and renewals.

-

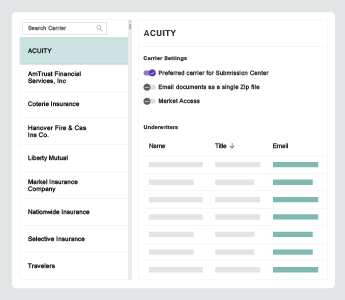

Keep underwriter details organized

Keep underwriter details organized

An underwriter management tool organizes carrier underwriter contacts, assigns them to specific submissions, and maintains visibility of all submissions assigned to each representative during the underwriting process.

-

Generate more leads

Generate more leads

Our consumer quoting tool lets prospects request a quote directly from your agency’s website 24/7. They can even text a keyword to your agency to receive an auto quote directly on their phone (Quote By Text is an EZLynx exclusive!).

Why choose EZLynx for rating and submissions?

Streamline CL Submissions in One Place

Send submissions for an instant quote via email, automating work in a single-stream workflow.

Quote More Faster

Stand out from the crowd with a streamlined, modern approach to presenting Home and Auto quote proposals.

Meet Customers Where They Want to Do Business

Allow prospects to request a quote through a simple text message with Quote By Text.

The impact EZLynx has on rating and submissions

-

$142B

In premium quoted across our CL and PL rating solutions in 2023

-

80 Minutes

Saved per risk when quoting with a commercial rater

-

$50

Saved per risk when quoting with a commercial rater

Real insurance agents trust EZLynx

Resources

-

10 Must-Haves for Your Insurance Rating Software

10 Must-Haves for Your Insurance Rating SoftwareLearn how insurance comparative raters can help your agency save time, increase quote volume and improve your value proposition.

Read Now

-

Purchasing the Right Rating Software for Your Agency

Purchasing the Right Rating Software for Your AgencyDiscover everything you need to know before purchasing the perfect comparative rating system for your business.

Read Now

-

Maximize Commercial Lines Profits – The Insurance Agent’s How-To

Maximize Commercial Lines Profits – The Insurance Agent’s How-ToLearn how you can leverage the latest tech to streamline tasks, save time, and tap into the full potential of commercial lines.

Read Now

Resources

-

10 Must-Haves for Your Insurance Rating Software

10 Must-Haves for Your Insurance Rating SoftwareLearn how insurance comparative raters can help your agency save time, increase quote volume and improve your value proposition.

Read Now

-

Purchasing the Right Rating Software for Your Agency

Purchasing the Right Rating Software for Your AgencyDiscover everything you need to know before purchasing the perfect comparative rating system for your business.

Read Now

-

Maximize Commercial Lines Profits – The Insurance Agent’s How-To

Maximize Commercial Lines Profits – The Insurance Agent’s How-ToLearn how you can leverage the latest tech to streamline tasks, save time, and tap into the full potential of commercial lines.

Read Now