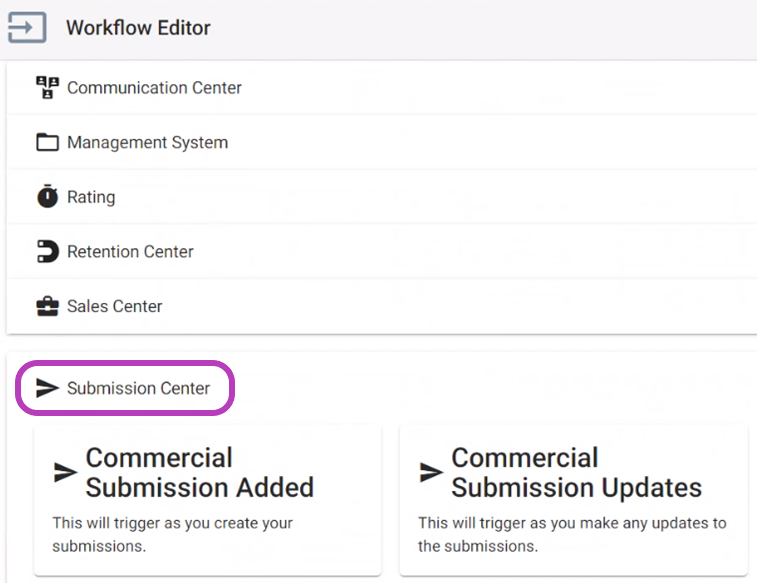

Automation Center Adds Support for EZLynx Submission Center

Policy Audit and Reinstatement Workflows Added to Automation Center

Triggers for Policy Audit and Policy Reinstatement have been added to EZLynx Automation Center. These new workflows, found under the Management System category, empower your agency to automate activities around these milestones in the life of your clients’ policies.

These workflows work for both downloaded and manual policies, and they can be set up to automatically take the following actions when triggered:

- Create Note/Task

- Send Email

- Create Folders

- Send Text Message

- Generate Agency Documents

- Generate Client Documents

Improvements to Application and Policy Data Entry

We’ve made enhancements to several policy and application screens.

- Small Farm and Ranch screens have been updated for a more intuitive flow as you enter data and navigate between the different tabs.

- Personal Lines Package Policy and Bundled Application screens have been improved to provide single policy entry of insured information, underwriting, and additional interests. (Essentially, we’ve taken the common framework that already existed for commercial lines of business and extended them to personal lines, as well.) This not only reduces the amount of time it takes to create a Personal Package, but it also reduces the duplicate data your agency needs to enter and manage.

- For Bonds Miscellaneous, we’ve created an entry screen for a line of business that didn’t previously feature entry screen support. This enhancement makes it easier to work with this line of business in bundled policy applications, and it also facilitates more robust policy information when servicing the client. Whether adding a policy or creating an application, you will now be able to enter relevant insurable interests information, including sections for: Liability, Property, Item/Schedule, and General Remarks/Notes.

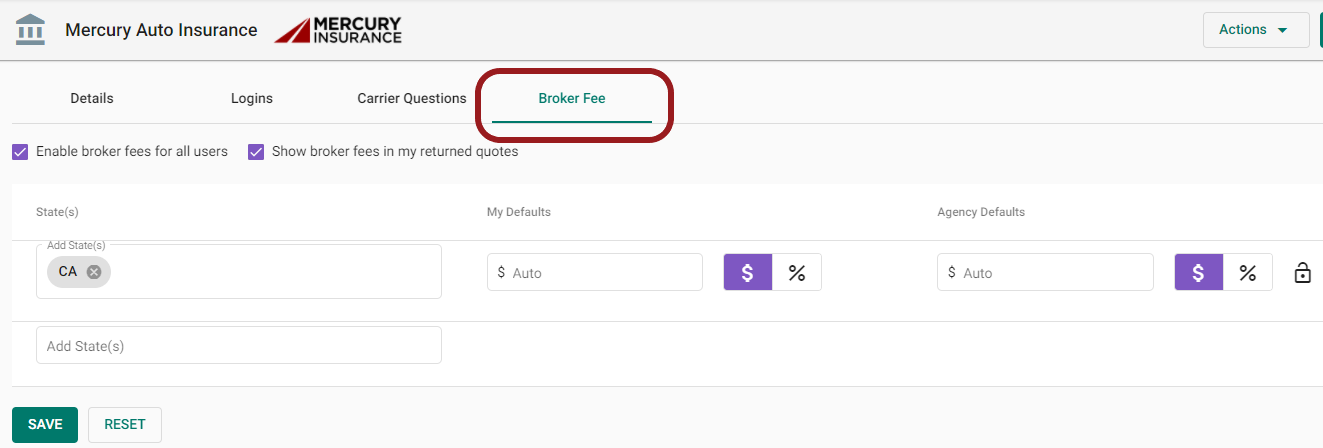

Rating Broker Fee

In EZLynx Rating Engine, we’ve added support for the management of broker fees. Broker fees can be set up by carrier, state and line of business, and you may enter a flat dollar amount or a percentage up to two decimal places. Once set up, these broker fees will display as a separate line item during the quoting process.

This new feature is key in several states, including agencies writing business in California.

To set up broker fees for your agency, admins can enable from the new Broker Fee tab under any Rating carrier’s Settings.

NOTE: This feature is currently available for Retail agencies, only.

Rating Engine Updates

We’ve made some state-specific updates to Rating Engine, including:

- Massachusetts agents now have the ability to access the Massachusetts Registry of Motor Vehicles (RMV) database to look up driver incidents (violations, accidents, and comp losses) and import them into EZLynx at no additional cost!

- In certain cases, new Virginia state laws will require double the new state minimums for Auto applicants with alcohol-related offenses. We’ve added $60,000/$120,000 options for Bodily Injury and Uninsured/Underinsured Motorist coverages, as well as $40,000 for Property Damage and Uninsured Property Damage on the Coverage screen.

Client Center Expands Commercial Schedule Change Requests

Last year, we introduced the ability for your commercial auto insureds to request changes to their driver schedules through EZLynx Client Center. This gave clients an easy, online way to submit these change requests at their own convenience. It was a real game-changer, because it meant no additional data entry on the agency’s part! With this release, we’re expanding commercial policy change request capabilities with the addition of several more schedules and LOBs:

- Vehicle – Commercial Auto

- Lien Holder – Commercial Auto, BOP, General Liability

- Additional Insured – Commercial Auto, Garage and Dealers, General Liability, BOP, Commercial Umbrella

- Mortgagee – BOP, Commercial Property