We all know that using analytics is a key trait of successful companies, but many independent agency owners are “too busy” to focus on their business analytics. They skim over various reports or spreadsheets, but become overwhelmed by too much data to focus on the root of the issues.

The Problem

All management systems provide massive amounts of data on customers, policies, premiums, and more, but all the reports in the world will not help an owner who doesn’t know how to take action in the correct areas.

Of those that are spending the time to utilize the data, many are still operating under the “experience trumps analytics” mindset. Owners will make business and marketing decisions based on their gut rather than understanding how to use the analytics to strategically increase their bottom line.

In reality, management system reports are only useful if agency owners are looking at the most important metrics, understanding what they mean, and using them to formulate and implement an action plan for the agency.

The Solution

- Easily and accurately identify the important metrics using tools like EZLynx Agency Pulse. If you spend time calculating them by hand from your management system data, you probably won’t have the time to do this on a consistent basis.

- Understand these metrics for your agency. Know which calculations to track and what they mean for the agency.

- Implement an action plan and track the results. Depending on the current health of your agency, some changes may take longer than others. The only way to determine if your strategy is working is to track the small changes month over month.

To utilize this in your agency, you must first identify the three most important areas in high growth agencies:

- New business

- Policies per customer

- Retention

Each of these areas contain specific metrics that directly correlate to an agency’s overall health and build the bottom line.

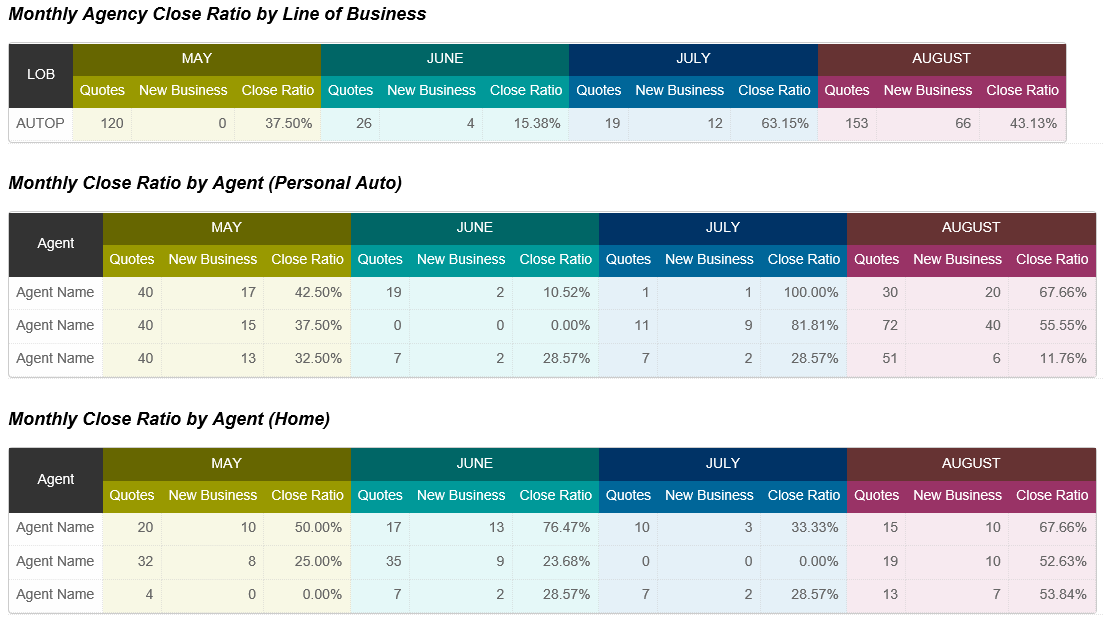

New Business

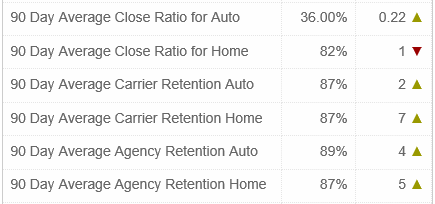

This category represents the net new growth in the agency. The total numbers are easily tracked through most management systems, but to fully understand the agency’s growth, one must also know where the growth is coming from. Owners can identify strong areas of new growth by looking at the close ratios by LOB. You can compare the total number of quotes to the total number of new policies for each LOB to determine strengths and weaknesses for an agency. Tracking the close ratio for each agent helps you focus on internal training by determining the strengths and weakness of each producer. This type of targeting is relatively simple, but you can’t do it unless you track and understand these metrics.

This category represents the net new growth in the agency. The total numbers are easily tracked through most management systems, but to fully understand the agency’s growth, one must also know where the growth is coming from. Owners can identify strong areas of new growth by looking at the close ratios by LOB. You can compare the total number of quotes to the total number of new policies for each LOB to determine strengths and weaknesses for an agency. Tracking the close ratio for each agent helps you focus on internal training by determining the strengths and weakness of each producer. This type of targeting is relatively simple, but you can’t do it unless you track and understand these metrics.

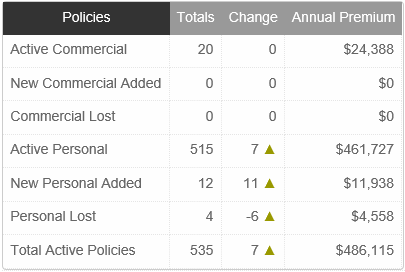

Policies per Customer

This is arguably one of the most important areas to track, because it affects so many other areas including marketing ROI, retention, average revenue per customer, and average premium per policy. It is also one of the most helpful statistics in determining the effectiveness of cross selling campaigns. An agency owner who accurately tracks the number of policies per customer can set goals and strategies to increase this number.

For some agencies, it can be as simple as striving to educate every customer on the agency’s product offerings and the areas where the customer may have gaps. In others, it could be increased through a cross selling campaign to your existing customer base. Since the number is also used to calculate the average revenue per customer and average premium per policy, this is a vital calculation for every agency owner. Policies per customer also relates directly to an agency’s retention rate. Statistically as the number of policies approaches four, the average retention increases from three years to ten years. Which brings us to the third and final area for every agency to monitor – retention.

For some agencies, it can be as simple as striving to educate every customer on the agency’s product offerings and the areas where the customer may have gaps. In others, it could be increased through a cross selling campaign to your existing customer base. Since the number is also used to calculate the average revenue per customer and average premium per policy, this is a vital calculation for every agency owner. Policies per customer also relates directly to an agency’s retention rate. Statistically as the number of policies approaches four, the average retention increases from three years to ten years. Which brings us to the third and final area for every agency to monitor – retention.

Retention

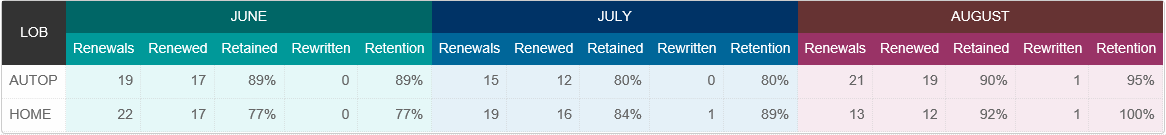

These metrics represent the financial longevity of an agency. The insurance industry as a whole has one of the highest customer acquisition costs of any industry, so it is even more imperative to retain the ones you have. Doing this begins with knowing retention rates separated by LOB, carrier, and the agency as a whole. This is one area where many agency owners rely more on intuition than actual statics. They use their gut to predict which carrier’s rates are competitive or the overall agency retention rate. Frequently, agencies completely ignore renewal all together unless a customer specifically calls the agency. The reactive approach causes many agencies actual retention rates to fall. A high retention rate fuels financial growth and profitability.

These metrics represent the financial longevity of an agency. The insurance industry as a whole has one of the highest customer acquisition costs of any industry, so it is even more imperative to retain the ones you have. Doing this begins with knowing retention rates separated by LOB, carrier, and the agency as a whole. This is one area where many agency owners rely more on intuition than actual statics. They use their gut to predict which carrier’s rates are competitive or the overall agency retention rate. Frequently, agencies completely ignore renewal all together unless a customer specifically calls the agency. The reactive approach causes many agencies actual retention rates to fall. A high retention rate fuels financial growth and profitability.

Putting it all together

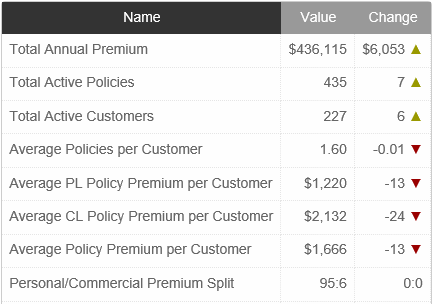

EZLynx provides these metrics and many more in an easy to read report delivered directly to the agency owner. Since EZLynx is a single platform solution, we combine data from EZLynx Management System and EZLynx Rating Engine into an easy to read snapshot used to evaluate the health of the agency.

Agency Pulse is just one feature of EZLynx Management System that has helped it become fastest growing management system of 2014.